Samsung maintained its top spot in NAND flash market during Q3 2022

Last updated: November 26th, 2020 at 08:59 UTC+01:00

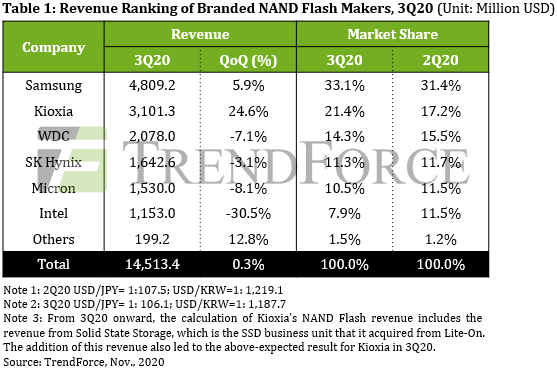

Samsung is the leader in the DRAM and NAND flash semiconductor markets, and it has managed to maintain its lead in the previous quarter. Co-ordinate to a new written report from market place research business firm TrendForce, Samsung was the biggest NAND flash brand in the earth with a market share of 33.1%, which is college than its market share from Q2 2020.

During the third quarter of 2020, Samsung's revenue from its NAND flash business was $4.8 billion, which is a 5.9% quarter-on-quarter improvement. Yet, the company'due south ASP (average selling price) dropped 10% every bit the overall demand was afflicted by inventory reduction efforts by its clients. The company managed to get-go the price reject by increasing the shipments.

Kioxia, which is Samsung's biggest rival, had a market share of 21.four% in Q3 2020. Western Digital'due south market share was 14.three%, SK Hynix's market place share was eleven.3%, Micron's market place share was 10.5%, and Intel's market share was 7.9%.

Huawei was compelled to buy NAND wink chips for 1 last fourth dimension before it was cut off from Samsung following the United states of america sanctions. Fifty-fifty Apple tree made a huge order of storage chips before the launch of the iPhone 12 series, which benefitted Samsung'southward business.

A bulk of the company's revenue still comes from its 92-layer NAND wink chips that come from its V5 line, but the visitor is stepping upwards efforts to go more clients for its 128-layer SSDs and UFS chips. The transition from Samsung's V5 to V6 lines will exist more pronounced in 2021. The company will continue to aggrandize its 11'an manufacturing base and it has plans to manufacture 176-layer and 192-layer chips.

Source: https://www.sammobile.com/news/samsung-maintain-top-spot-nand-flash-market-q3-2020/

Posted by: warebeffele61.blogspot.com

0 Response to "Samsung maintained its top spot in NAND flash market during Q3 2022"

Post a Comment